We will first describe how a bank might be organized before computers were invented. The bank has a number of customers. A customer may deposit or withdraw money in the bank. The bank keeps information about each customer in the form of an account that keeps track of the current balance for the customer. A bank clerk will have to be able to perform the following tasks:

- When a customer enters the bank, the clerk must be able to find the account of the customer.

- For a new customer, the clerk must be able to create a new account.

- The clerk must be able to receive money from the customer for deposit on his/her account.

- The clerk must be able to give money to the customer by withdrawing money from his/her account.

- The clerk should also be able to loan money to the customer.

- The clerk (or bank) must be able to add interest to the account.

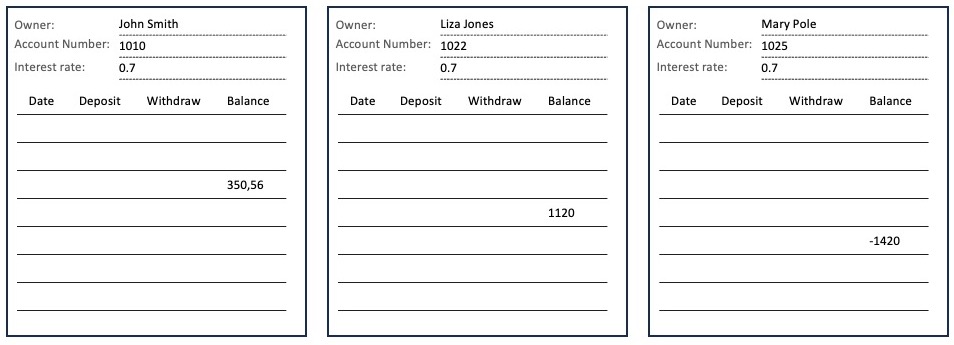

For each customer the bank keeps an account in the form of a file that consists of one or more pieces of paper. A piece of paper may have the format as shown in Figure 2.1, which shows three accounts.

Figure 2.1 Example of paper-based accounts

The information in an account is the name of the owner of the account and the current balance of the account. In addition, each account has an account number. One of the accounts is owned by John Smith, has a current balance of 350.56, and the account number is 1010.

In this very simple example, we only have one type of account. If the balance on the account is positive, we assume that the customer has put money in the bank. If the balance is negative, we assume that the customer has borrowed money from the bank. As can be seen, Mary Pole has borrowed an amount of 1420.

The bank has an account for each customer, and all the accounts are kept in a cabin where there is a folder per account.

When a customer visits the bank and asks for service, a bank clerk finds his/her account in the cabin and performs the desired transaction (deposit or withdrawal) by changing the balance field.

If a new customer wants to use the bank, the clerk will have to create a new account. For this purpose, the bank has preprinted paper where the clerk may fill in the details of the customer, such as name of the owner, and the current balance.

Every quarter, one or more clerks go through all accounts and add interest. If the balance is positive, the customer earns interest. If the balance is negative, the customer pays interest.

We have of course made a number of simplifications compared to a real bank. In a real bank, there are many different types of accounts, such as saving accounts and checking accounts. In addition, a record is kept for each transaction that has been made on a given account.